Stock in Focus: Zip Co Ltd (ASX:ZIP)

What are our 3 key drivers for the company?

- Active customer growth: After a period of anaemic customer growth, Zip has seen its active customer book grow on the back of increased brand awareness and partnerships with key merchants in the US. We expect the positive momentum in US active customer growth to continue as Zip takes market share.

- Customer engagement: Customer engagement has been a key growth driver in the US with transactions per customer +36% and +34% in FY24 and 1H25 respectively. This increased engagement has been driven by physical card uptake and in-app product developments, both tailwinds we expect to continue over the medium term.

- Bad debt management: The Company’s ability to drive top-line growth and manage bad debts at the same time has been critical to improving the net margin profile of the business over the past two years. Management has balanced both side of this equation through its seasoned credit evaluation model which starts appraising new customer repayment behaviour after just 14-days.

What do we think the company is worth?

Lennox’s valuation is typically based on a combination of our year-3 earnings forecast for the company, coupled with the PE premium/discount we believe the business should trade on. Zip is currently trading on an FY28 PE of 18x and forecast to grow its cash earnings at +30% CAGR over the next 3-years. On that basis we believe ZIP could be worth $4+ per share by FY28.*

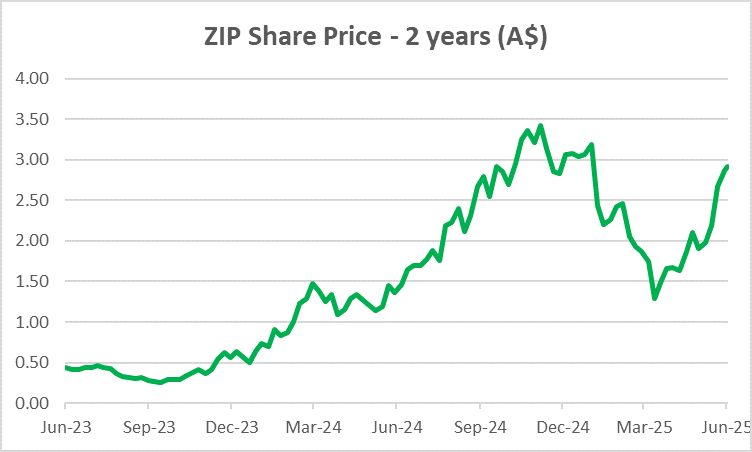

*Current Price as at 25 June 2025: $2.92 AUD

This material has been prepared by Lennox Capital Partners Pty Ltd ABN 19617001966 AFSL 498737 (Lennox). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon.

Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.