Unlock growth potential with a fund designed to identify Australia’s most promising small companies.

The Lennox Australian Small Companies Fund is a high-conviction, actively managed portfolio built on deep research, disciplined risk management and a proven investment philosophy.

We find the leaders of tomorrow — emerging businesses with the potential to become market powerhouses. Our founders are majority owners in the business, investing alongside our clients, and have a long track record of generating returns.

The Lennox Australian Small Companies Fund at a glance:

20–40 Australian & New Zealand small companies

Aims to outperform the S&P/ASX Small Ordinaries Accumulation Index over the medium to long term

Qualitative screening and fundamental research to uncover opportunities

Our Fund

Launched in April 2017, the Lennox Australian Small Companies Fund is an actively managed portfolio that invests in a broad range of high quality smaller companies. Our objective is to identify investment grade businesses that are undervalued as a result of structural, cyclical or company-specific change.

We apply fundamental analysis and in-depth research to find businesses with:

- Experienced management teams

- Forecastable and sustainable real earnings

- Favourable industry dynamics, including barriers to entry and product differentiation

Fund Performance

The Fund aims to outperform the S&P/ASX Small Ordinaries Accumulation Index over the medium to long term (after fees).

Lennox Australian Small Companies Fund – Performance (after fees) as at 31 January 2026

Past performance is not a reliable indicator of future performance. Numbers may not add due to rounding.

1. Returns are calculated after fees have been deducted and assume distributions and been reinvested. No allowance is made for tax when calculating these figures.

2. The inception date for the Fund is 28 April 2017.

3. The benchmark for the Fund is the S&P/ASX Small Ordinaries Accumulation Index. For comparison purposes, the S&P/ASX Small Industrials Accumulation Index is displayed as the Fund does not typically invest in resource securities.

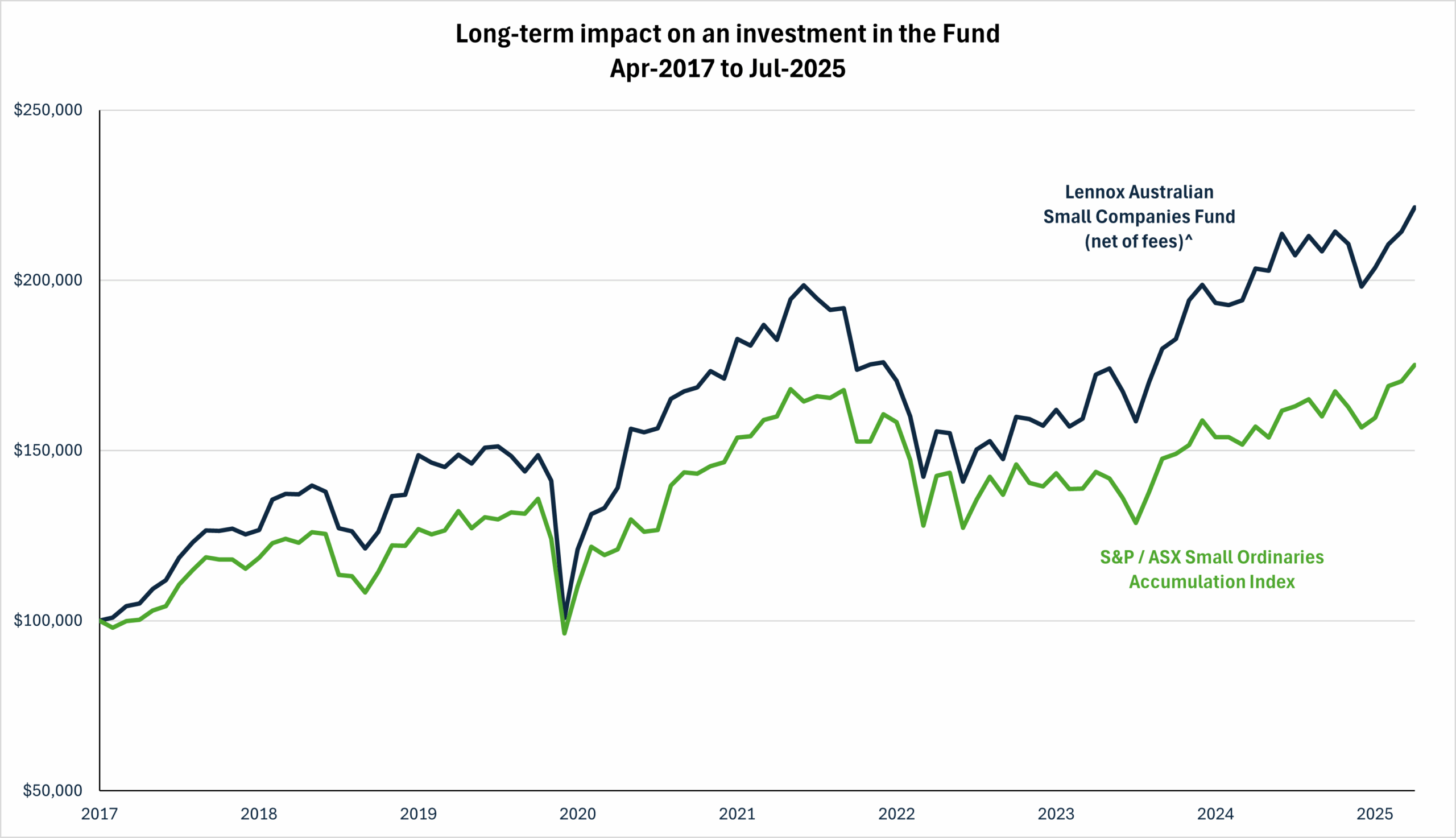

Performance of $100,000 invested since inception (net of fees)^

^Past performance is not a reliable indicator of future performance. As at 31 July 2025. Returns are calculated after fees have been deducted and assume distributions and been reinvested. No allowance is made for tax when calculating these figures. The inception date for the Fund is 28 April 2017. The benchmark for the Fund is the S&P/ASX Small Ordinaries Accumulation Index.

Interested in hearing more?

Watch our recent webinar on-demand.

Lennox Webinar: August Reporting Season Wrap-up

Lennox Portfolio Managers James Dougherty and Liam Donohue reviewed the performance of the Australian small-cap sector during the FY25 reporting season and shared their outlook and insights into corporate sentiment amid a period of market uncertainty. The session included a Q&A.

WATCH NOWOur Team

Lennox is led by experienced portfolio managers with deep industry knowledge and a track record of investing in smaller companies. Our structure strongly aligns the objectives of investors and investment staff.

James Dougherty

Principal & Portfolio Manager

Liam Donohue

Principal & Portfolio Manager

Latest insights

The case for an ‘ex-resources’ bias in Australian small-caps

The Australian small-cap market’s reliance on resource companies drives volatility and unpredictable earnings. In contrast, Lennox Capital Partners’ ex-resources approach has delivered stronger risk-adjusted returns and a smoother investment journey since 2017.

Portfolio & Investment Updates

In this video Liam Donohue and James Dougherty share a six-month portfolio update, covering standout performers, new positions and key investment themes. They discuss recent moves into AI infrastructure via a pre-IPO investment in Firmus, the growth outlook for Integral Diagnostics, and how the team is positioning for FY26.

August 2025 Reporting Season Review

In our latest video Portfolio Manager Liam Donohue shares key insights from the August 2025 reporting season. He outlines how the earnings of Lennox’s portfolio companies compared to the broader market, what the market’s earnings revisions are signalling, and why small caps are showing stronger growth potential than large caps heading into FY26.

Contact

To invest with Lennox, please contact Fidante, our distribution partner.

Retail Investors

1300 721 637 (within Australia)

02 8023 5428 (outside of Australia)

info@fidante.com.au

Financial Advisers, Wholesale & HNW Investors

1300 721 637 (within Australia)

02 8023 5428 (outside of Australia)

bdm@fidante.com.au

Institutional Investors and Asset Consultants

George Moromalos

Senior Institutional Business Development Manager, Fidante

Phone: +61 412 625 771

Email: gmoromalos@fidante.com.au

Our Partner – Fidante

Investment Excellence. Unlocked.

Fidante delivers access to exceptional investment strategies, managed by top-tier specialists across alternatives, fixed income, and equities. Backed by Challenger and a track record of award-winning distribution, Fidante helps you invest with confidence across every market and asset class.

"*" indicates required fields

Awards and Ratings

This material has been prepared by Lennox Capital Partners Pty Limited (ABN 19 617 001 966) (AFSL 498737) (Lennox), the investment manager of Lennox Australian Small Companies Fund (Fund).

Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Fund. Other than information which is identified as sourced from Fidante in relation to the Fund, Fidante is not responsible for the information in this material, including any statements of opinion.

It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Fund. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Past performance is not a reliable indicator of future performance.

Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon.

Lennox and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Lennox and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties.

Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (HOW3590AU assigned February 2025) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at https://www.zenithpartners.com.au/our-solutions/investment-research/regulatory-guidelines/.

Zenith Investment Partners Pty Ltd ABN 27 103 132 672 AFSL 226872 Fund Awards issued 18 October 2024 are solely statements of opinion and not a recommendation in relation to making any investment decisions. Fund Awards are current for 12 months and subject to change at any time. Fund Awards for previous years are for historical purposes only. Full details on Zenith Fund Awards at https://www.zenithpartners.com.au/zenith-fund-awards-2024/.

The rating published on 10/2024 for the Lennox Australian Small Companies Fund is issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). Ratings are general advice only and have been prepared without taking account of investors’ objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec Research assumes no obligation to update. Lonsec Research uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2025 Lonsec. All rights reserved.