We find the leaders of tomorrow — the emerging businesses with the potential to grow into powerhouses over coming years.

As active, bottom-up, fundamental investors, we’re proud of our track record identifying growing businesses with what we consider high-quality and sustainable earnings while also satisfying our clearly-defined expectations around ESG.

Our founders majority own the business, are invested in the strategies and have a long history of generating returns for investors.

The Lennox Australian Small Companies Fund — an actively managed, style agnostic portfolio that invests in a broad range of smaller companies.

Holds 20-40 Australian & New Zealand listed securities.

Uses both qualitative screening and in-depth fundamental research to identify investment opportunities.

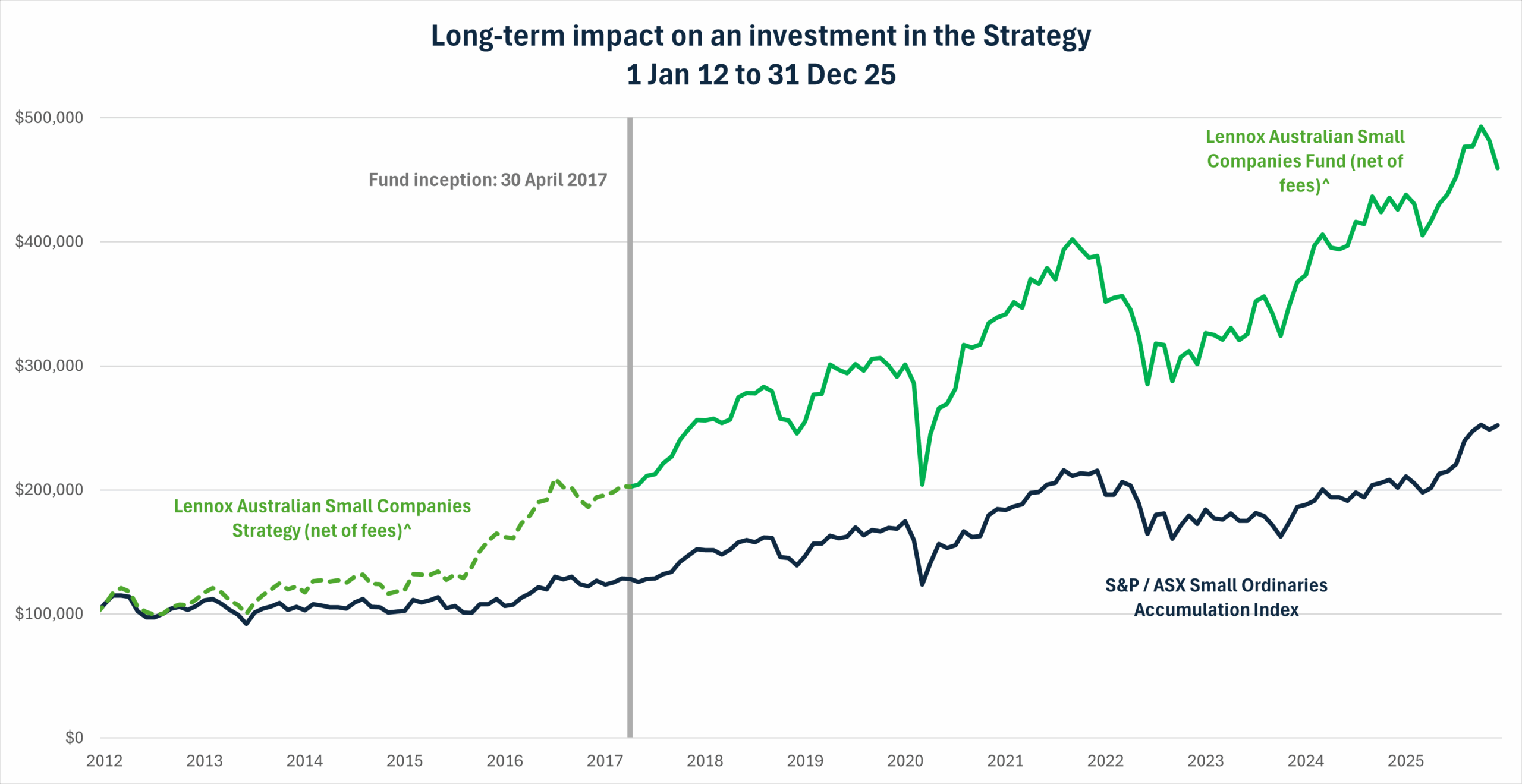

Aims to outperform S&P/ASX Small Ordinaries Accumulation Index over the medium to long term.

Excludes investments in controversial industries, including but not limited to companies with ownership in fossil fuel reserve. This means we do not invest in mining and energy companies that own the underlying resource assets.

Performance of $100,000 invested since inception (net of fees)*

*Past performance is not a reliable indicator of future performance. As at 31 Dec 2025.

The track record includes the actual performance of the Macquarie Australian Small Companies Fund from 1 January 2012 to 27 January 2017. James Dougherty was lead portfolio manager on this fund from 1 January 2012 to 27 January 2017. Liam Donohue was co-portfolio manager on this fund from 1 July 2015 to 25 January 2017. While both had primary responsibility for the fund over these specified time periods, they were part of a broader 10 person Macquarie Australian Fundamental Equity team. As part of the Australian Fundamental Equity team, James and Liam were also able to leverage a broader 27 person Macquarie Australian Equity team including capabilities across (but not limited to) quantitative screening, risk management and portfolio construction. For the period between 28 January 2017 and 30 April 2017, strategy returns have been assumed to be equal to that of the benchmark index performance minus the fund’s management fee. During this period, the strategy was not being managed by the investment team under a fund structure. Accordingly, annualised performance periods reflect actual composite monthly returns, with the exception of this period. Past performance is not a reliable indicator of future performance. Returns are calculated after fees have been deducted and assume distributions have been reinvested. No allowance is made for tax when calculating these figures.

Discover More

We believe ESG is integral to creating the leaders of tomorrow.

Environmental, social and governance factors are integrated into Lennox’s investment process and have formed part of our investment strategy since inception.

We take an active approach to improving the ESG outcomes of companies we invest in through engagement with both management and board members.

We believe our commitment to ESG enables us to deliver better long term returns for our clients.

We are proud to have four out of five star rating awarded by the UN-supported Principles for Responsible Investing (PRI).

Lennox is a signatory to the Net Zero Asset Managers initiative, committing to working with investor networks, companies and clients to support the goal of net zero emissions by 2050 or sooner.

Lennox Capital Partners is a proud supporter of the GO Foundation, an Australian charitable foundation that aims to build a future for Indigenous students by support through education.

Latest insights

The case for an ‘ex-resources’ bias in Australian small-caps

The Australian small-cap market’s reliance on resource companies drives volatility and unpredictable earnings. In contrast, Lennox Capital Partners’ ex-resources approach has delivered stronger risk-adjusted returns and a smoother investment journey since 2017.

Portfolio & Investment Updates

In this video Liam Donohue and James Dougherty share a six-month portfolio update, covering standout performers, new positions and key investment themes. They discuss recent moves into AI infrastructure via a pre-IPO investment in Firmus, the growth outlook for Integral Diagnostics, and how the team is positioning for FY26.

August 2025 Reporting Season Review

In our latest video Portfolio Manager Liam Donohue shares key insights from the August 2025 reporting season. He outlines how the earnings of Lennox’s portfolio companies compared to the broader market, what the market’s earnings revisions are signalling, and why small caps are showing stronger growth potential than large caps heading into FY26.